2021 Australian Cotton Crop Review

3 minute read

ACSA Staff Writer

As the curtain closes on ginning of the 2021 Australian Crop and preparations for 2022 begin in earnest, its worth reflecting on the remarkable events that have impacted the Australian cotton industry over the past year.

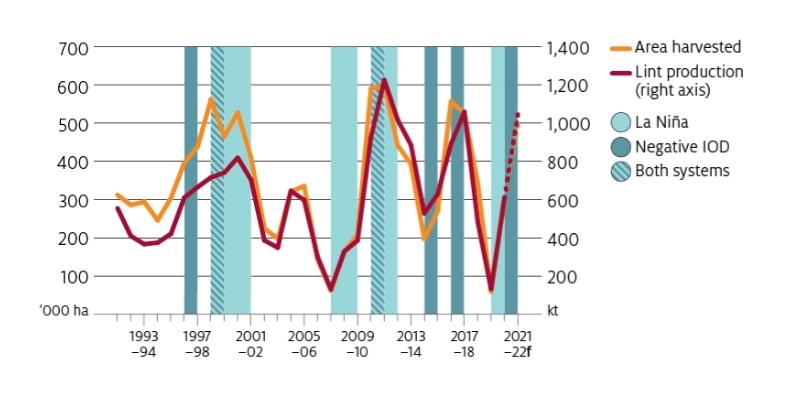

Just over a year ago, the 2021 crop was being planted against a backdrop of improving seasonal conditions. After successive years of crippling drought reducing the Australian crop to a recent record low production of just 134,000 MT* in 2020, finally cotton growers had something to smile about. A La Nina weather pattern brought soaking rains to the east coast of Australia in 2020, replenishing both soil moisture and dam levels.

Australian cotton growers responded, increasing plantings fourfold on the previous season, capitalising on the improving growing conditions and attractive prices. Above average rainfall persisted during the 2021 crop growing season, building water storage levels to underpin 2022 and 2023 production.

Australian Cotton Production and Climatic Patterns

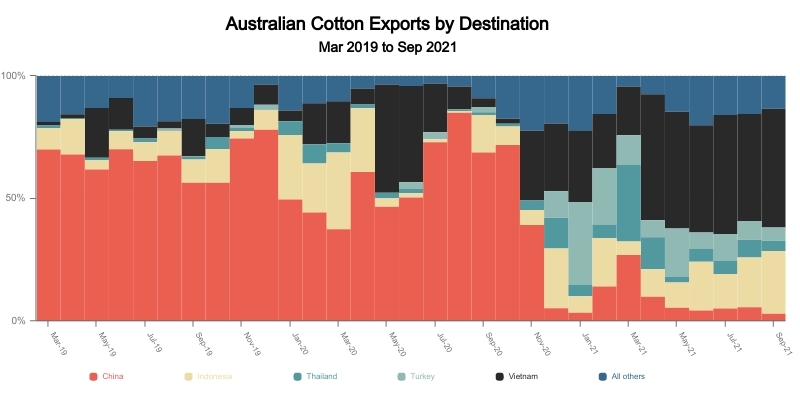

Meanwhile, in a global shipping environment severely impacted by the ongoing COVID-19 pandemic, the export destination mix for Australian cotton was shifting markedly. The largest market for Australian cotton exports over the previous decade effectively closed it's doors to Australian imports in late 2020. Faced with the same supply chain challenges confronting all exporters, Australian cotton shippers were now also looking for markets for a growing Australian crop.

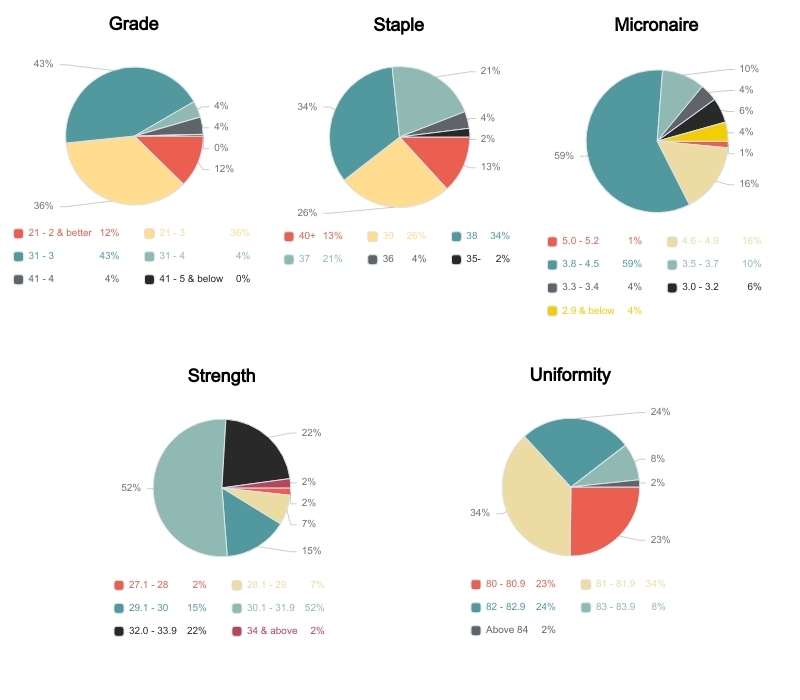

When the harvest of what would eventually be the 608,000 MT* 2021 crop commenced in March, the wetter than usual weather pattern was still prevailing. Whilst Australian cotton growers were buoyed by improving prospects for next season's cotton production and cereal crops in the winter, the ongoing weather did have an impact on the quality of the 2021 Crop. Whilst grade, staple, strength and uniformity were largely in line with historical averages, low micronaire cotton was more prevalent in the 2021 crop than usual, with 24% of production classified below the benchmark 3.8 - 4.5 micronaire range.

2021 Australian Crop Quality Summary

Australian cotton growers continued their unwavering focus on sustainability during the 2021 season with 970 growers involved in the myBMP program, an increase of almost 7% on the previous year. 25% of production was also certified as BCI.

With exports to China winding down and access to some markets restricted by shipping and logistics, Australian cotton exporters pivoted. The percentage of Australian cotton exports to Vietnam, Turkey, Thailand and Indonesia all increased during 2021 as spinning mills in a range of markets made the most of the opportunity to source high quality, Australian cotton at competitive levels. Export volumes gathered pace over the course of 2021, reaching a year-to-date peak of 550,000 bales in September. This demonstrates that despite challenging global shipping conditions, Australian exporters are ensuring the industry is meeting the needs of our customers across the globe.

The 2021 Australian cotton season will go down as a one of incredible contrasts. Most importantly, the production outlook for Australian cotton improved dramatically, with both government and private water storages at levels that will underpin production for several years. The export and shipping environment was turbulent, but once again our industry has demonstrated it resilience and commitment to meeting the needs of our valued customers.

*ABARES Forecasts